China’s Automotive Market Transformation in 2025: The Rise of New Energy Vehicles and the Steady Presence of Fuel Vehicles

LFT (Xiamen) New Materials continues to focus on advanced automotive modification materials, providing high-quality solutions tailored for both sectors.

1. Automotive Market Landscape

“New Energy Leads, Fuel Vehicles Endure”

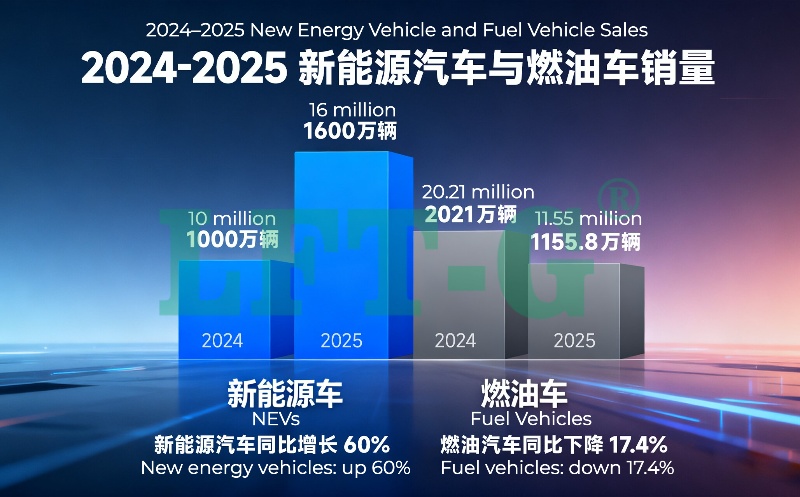

In 2025, the penetration rate of new energy vehicles (NEVs) in China is expected to reach 60% (16 million units), while fuel vehicle sales are projected at 11.558 million units, representing a 17.4% year-on-year decline.

Government policies continue to steer the market toward electrification. However, fuel vehicles maintain an irreplaceable role—supported by a stock of 1.3 billion vehicles, convenient refueling infrastructure, and a mature after-sales system—especially in long-distance transport and areas with limited charging facilities.

In 2024, exports accounted for 78% of total output, reinforcing a dual-track industrial structure where both fuel and electric vehicles coexist as the core of the automotive market.

2. Dual Upgrades in Market Supply and Demand

"New Industry Demands Under the Parallel Development of Fuel and Electric Vehicles"

The diversification of market demand has driven a differentiated development trend in the production and sales of fuel and new energy vehicles, while also creating higher requirements for automotive materials. Through technological optimization, manufacturers aim to extend product life cycles.

Demand is driving technological iteration, making material upgrades a shared consensus across the industry.

For new energy vehicles, the urgent need for lightweight solutions stems from the challenge of balancing battery cost and driving range — reducing weight by 10% can improve range by 5–7%.

For fuel vehicles, lightweighting helps meet increasingly strict emission standards and improves fuel efficiency.

Lightweight materials have therefore become the common choice for automakers. By 2025, the market size in China is expected to exceed 280 billion RMB, with the penetration of high-strength steel and aluminum alloys continuing to rise.

3. Forum for Collaborative Insights

Empowering the Industry through Material Innovation – LFT Materials

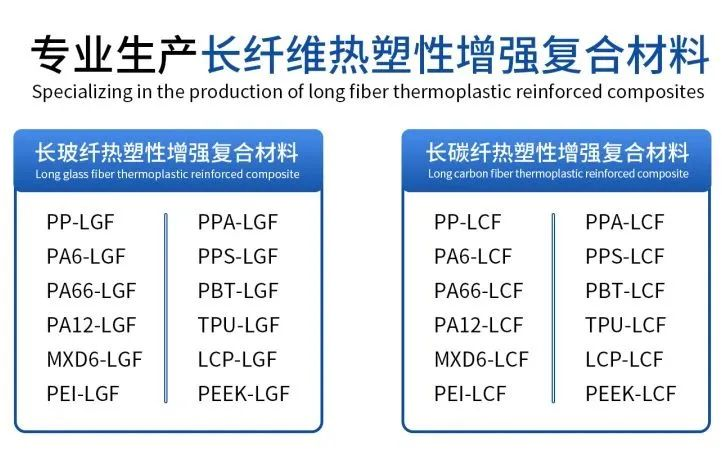

The CPRJ Automotive Plastics Forum brought together 400+ decision-makers from the automotive industry chain, focusing on topics such as intelligent evolution, low-altitude economy, and zero-carbon racing. Our LFT-G series products (long glass fiber PP, long carbon fiber PA66) have been applied in components like underbody shields and seat frames, helping to improve lightweighting and durability for new energy vehicles. At the forum, we will showcase innovative applications and sincerely seek industry collaborations.

Under the trend of automotive lightweighting, "plastic replacing steel" has become a mainstream approach. By leveraging the advantages of LGF—such as low linear expansion coefficient, high specific strength, high specific modulus, and excellent stability—its application in lightweight automotive structures can effectively reduce vehicle weight, enhance power performance and handling, lower energy consumption, and increase driving range.

Long glass fiber reinforced composites show significant potential in the lightweighting of new energy vehicles. LGF materials offer excellent mechanical properties and energy absorption, making them suitable for components such as front-end modules, sunroofs, dashboards, center consoles, and seats. Looking ahead, with continuous innovation in long fiber composites, their application in new energy vehicles is expected to become even more widespread!

You are cordially invited to the 14th CPRJ Plastics in Automotive Conference and Showcase, taking place on Nov. 13–14, 2025 at Crowne Plaza Shanghai Anting (No. 6555 Boyuan Road, Jiading District, Shanghai, China). Join us to explore the latest innovations in automotive plastics and discover how LFT-G materials are shaping the future of vehicle lightweighting.